Our investment strategy

SGT Capital Value Proposition

SGT Capital Group is a global private equity firm that generates top decile performance for its investors by driving the internationalisation of mid-cap market leading businesses in combination with more traditional private equity value creation strategies.

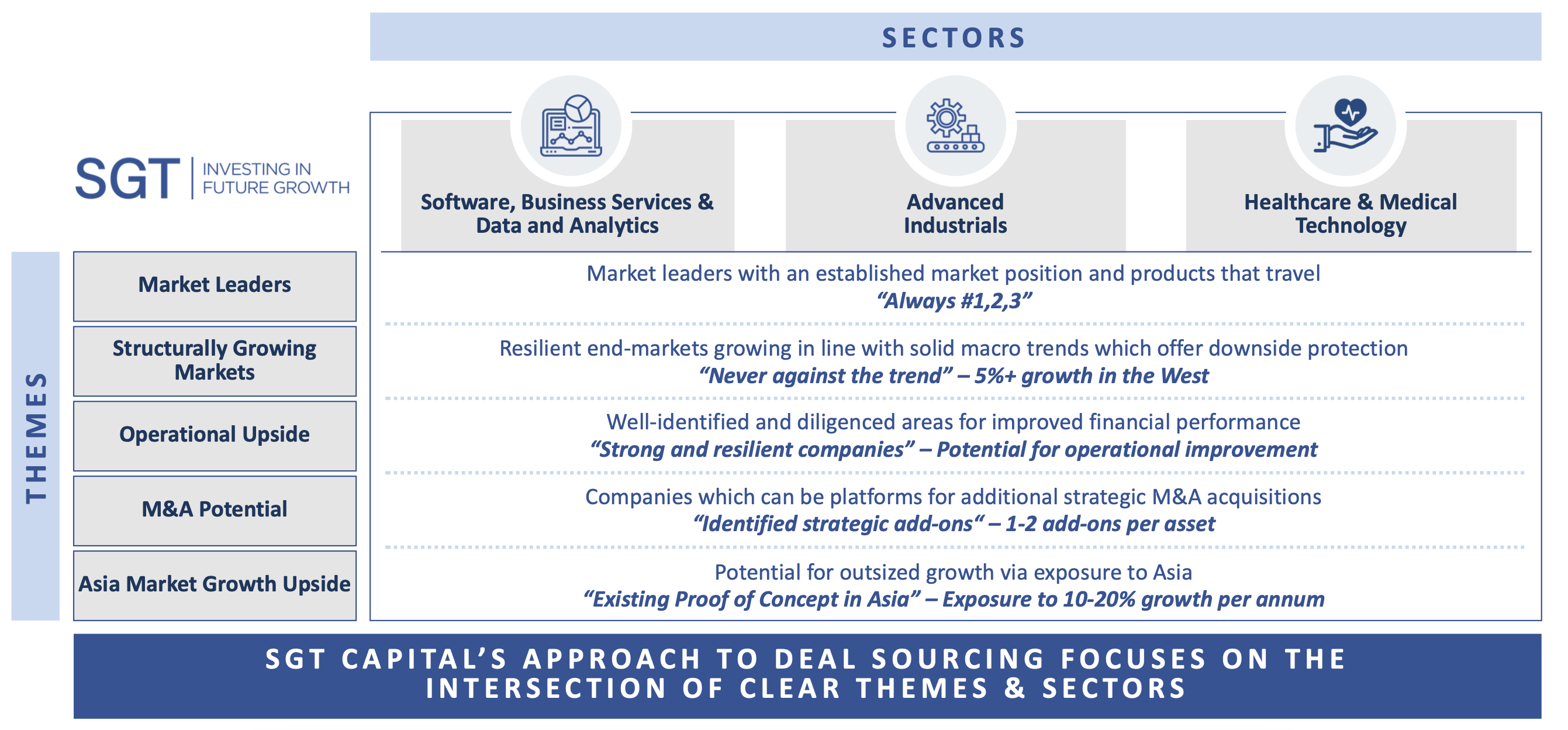

Three Horizon Investment Strategy

SGT Capital will deploy its three-horizon investment strategy, which it follows in a disciplined manner, to investments it makes. Specifically, SGT Capital will buy assets with downside protection to preserve investor capital. It will align the assets for growth and streamline operations, thereby delivering strong returns in the targeted deal lifespan of three to five years for the Fund’s investments. SGT Capital also seeks to generate superior returns by accelerating growth in Asia and through strategic M&A. The following Figure 1 illustrates the three-horizon investment strategy.

Figure 1: SGT Capital’s Three-Horizon Investment Strategy

- Acquire: SGT Capital typically acquires assets in Western European, including Israel, and selectively North American headquartered, market leading companies which are #1, 2 or 3 in their respective segments. The assets tend to be resilient businesses operating in structurally growing markets and are sought to be acquired at the right price to ensure downside protection. These companies typically offer superior products and have competitive advantages over their competitors. Selecting such assets gives the Fund confidence that there is inherent downside protection due to the strong underlying core of the company. SGT Capital also seeks to acquire assets with an existing “proof of concept” in Asia and proven potential to grow in this region. Assets which do not meet these requirements tend not to be considered.SGT Capital generates superior returns by driving the internationalisation of mid-market businesses in combination with more traditional private equity value creation strategies.

- Align: SGT Capital aims to align the businesses it acquires to unlock their strategic and operating potential. Through high quality and detailed diligence, operational value creation drivers are identified at the time of investment. The team then enables value creation by applying traditional private equity value creation strategies. These include institutionalisation of the businesses by selecting the best strategy for the business, appointing stronger c-suite executives, and improving the sales organisation. SGT Capital also focuses on optimisation of the businesses. This includes improving profitability by, for instance, digitisation of businesses to enhance efficiency. In addition, SGT Capital typically commercialises assets by focusing on key product lines and improving sales force effectiveness to ensure the most profitable and strategic products are sold.

- Accelerate: SGT Capital seeks to accelerate the growth of acquired and aligned businesses by enhancing their distribution to unlock their full growth potential, expanding into previously under-penetrated markets (mainly in Asia) which tend to have 10%-20% growth expectations per annum for the profits and growth of the acquired company. Additionally, SGT Capital aims to leverage on its strategic partnerships in Asia, thereby giving its Portfolio Companies the access to resources on the ground. Finally, selective assets with low M&A risk may be acquired to fast track the growth of a business. These add-ons are in line with the Fund’s investment strategy and either offer complementary products or are the insourcing of distribution partners.

This discipline and clear vision will enable SGT Capital to invest in businesses which are on-strategy for the Fund. SGT Capital further focuses on sectors and themes which are supportive to this strategy as described below.

SGT Capital Investment Focus

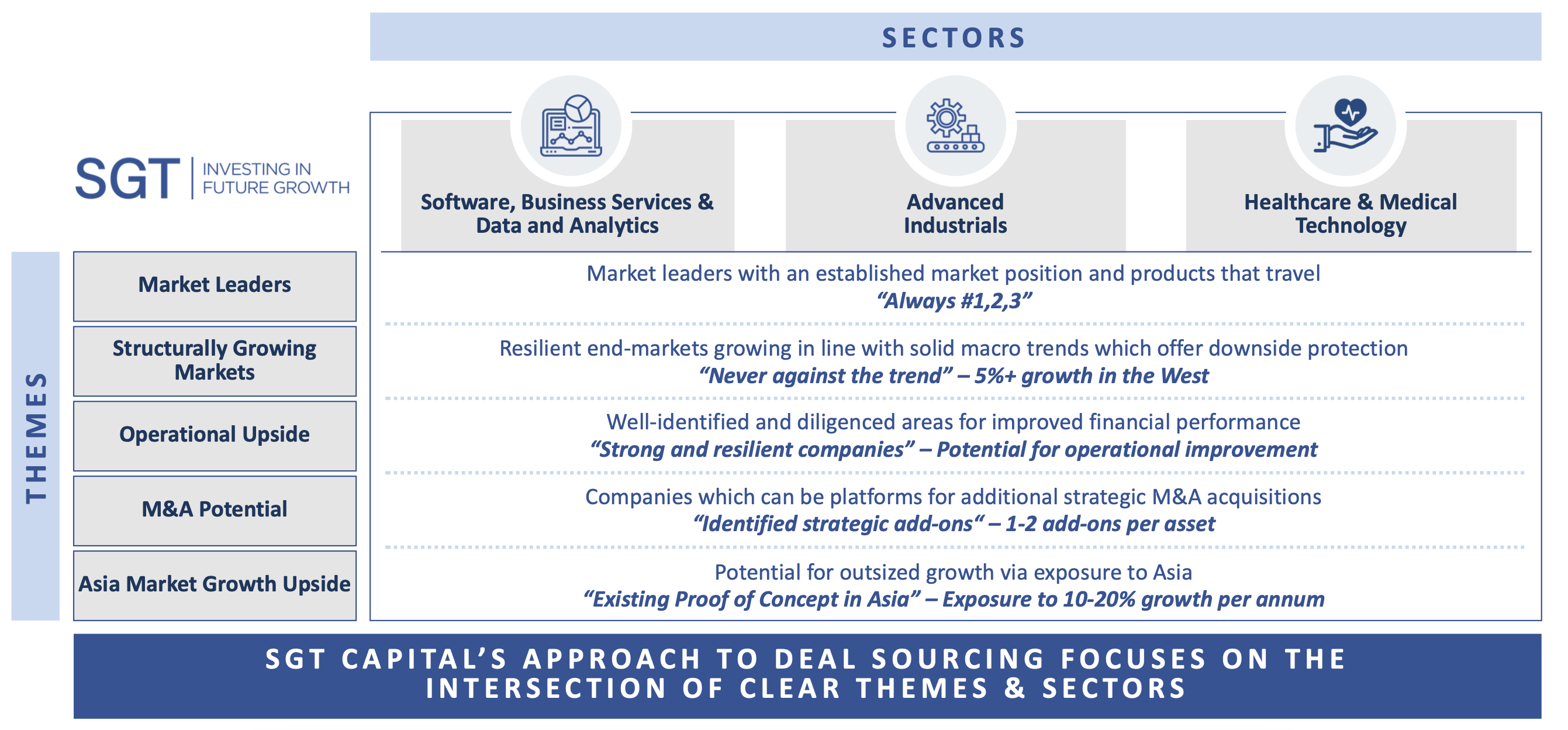

SGT Capital typically invests in those businesses that operate at the intersection of the Fund’s defined themes and sectors. Additionally, the Manager will seek to implement the Fund’s investment strategy at opportune points of the investment cycle and endeavors not to invest against the trend.

This process is designed to provide a robust deal sourcing mechanism, as well as a series of checks and balances to adequately screen potential investment opportunities and leverage the analytical strength of the SGT Capital team who have over 100 years of collective experience in deal-making. The key investment considerations are set out in Figure 2 below.

Figure 2: SGT Capital Key Investment Considerations: Themes and Sectors

Five Key Themes

SGT Capital’s investment strategy focusses on five key themes. These are:

- Market Leaders: Invests in market leaders who are typically #1, 2 or 3 in their segment. These businesses tend to have a strong core business and command a solid market share in the regions they currently serve.

- Structurally Growing Markets: Targets resilient companies growing in line with macro trends, offering downside protection. Target companies conventionally operate in markets with 5%+ growth per annum in the West and investments are typically “never against the trend”.

- Operational Upside: Identifies companies with well-identified and well-diligenced areas for improving financial performance. Target companies should be strong and resilient and have clear potential for rapidly seeing the benefits of operational efficiencies through improved management. SGT Capital does not do turnarounds.

- M&A Potential: Seeks companies which have the potential to act as platforms for additional strategic M&A acquisitions. There are typically one to two add-ons per asset under the condition that each add-on has a clearly identified strategic benefit to the platform.

- International Growth Upside: Targets companies that have the potential for outsized growth via exposure to global markets. Target companies also ordinarily display an existing “proof of concept” and have a presence in Asia.

All these criteria should be met for the Investment Team to consider an investment. The SGT Capital team has identified key sectors where the themes and value proposition can be effectively applied.

Clear Sector Focus

SGT Capital has narrowed its scope to the following three sectors:

- Software, Business Services & Data and Analytics and Medical Technology, e.g., information services and technology,

- Advanced Industrials, e.g., high-end machinery / equipment, robotics, and environmental technology; and,

- Healthcare & Medical Technology, e.g., medical devices.

The Investment Team is disciplined in its investment process with investments typically made only in those companies which exist at the intersection of the Fund’s investment criteria and sectors. This discipline helps the Fund to focus on high deal conversion.